Running a family can be time-consuming to the extent that you hardly have enough time for yourself, let alone coming up with a family budget. However, creating a family budget is the best step to attain this financial freedom when you need fast title loans only if you want to travel abroad.

We should say that learning the dos and don’ts of setting up a family budget requires deliberate effort from you to understand its technicalities. Having said this, grab a seat and a cup of coffee as we walk you through tips on how to prepare family budgets:

1. Choose a Suitable Budgeting Tool

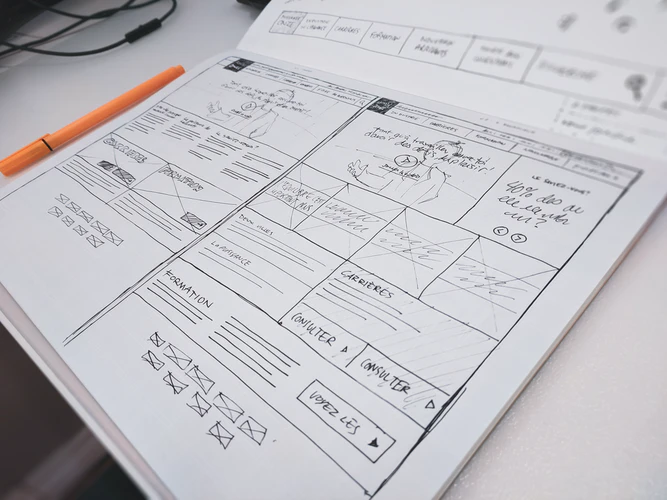

If you’ve been wondering what are the components of the family budget, and where you can start from, we have the answer. Start from the basics! Understand the type of budgeting tool that will work best for you in recording and analyzing your family budget.

There are currently two main types of such tools: the good old pen and paper ledgers and the second are digitized budgeting tools. If you like paper more, acquiring accounting ledgers is easy and affordable. This tool will help you track your incoming and outgoing money as it corresponds to your bank statements.

On the other hand, you can choose the easier way and get a family budget tracker online. This digitized budgeting tool will help you track your expenses and show how your credits and debits affect your financial goals. What’s more, the software they use will eliminate the need to write down and balance your sheets daily manually.

2. Factor in Your Bank Statements

Do you want to know how to manage the family budget? You need all the tools that summarize your outgoing and incoming funds. The best for you to start is with your bank statements and other devices such as receipts, loan interests, and credit card and bill statements.

After gathering all these tools, your next step should be placing them into either outgoing funds or incoming funds categories. Once you’re done, you should tally them and compare the totals from both categories. It’s common to find that your total outgoing amount is higher than the incoming amount, which shouldn’t make you too worried. You’ll see the tables turning once you learn how to make a family budget for a month and follow it to the letter.

3. Highlight Your Variable and Fixed Expenses in Your Family Budget

So, what are the elements of the family budget? Among many others, there are fixed and variable expenses. They are a crucial category that you need to bring out. Once you have the totals of your expenditure, you should subdivide this debit section of your family budget into subsections for better analysis.

These sub-categories could include fixed utilities such as water and electric bills and debts like a mortgage. Out of the many sub-sections that you can come up with for your expenses, the one you should pay close attention to is your discretionary expenditure (snacks, clothes, travel).

The reason for this is these expenses tend to accumulate quickly, and you’ll be surprised that they even surpass some of your fixed bills put together. At this point, you may be wondering how to plan family budgets and have more cash at the end of the month. The best way to achieve it is by monitoring and cutting costs in this sub-category.

4. Kickstart Your Ledger or Family Budget Program

Now when we understand what’s family budget is all about and how to plan for it, ensure that your budget categories and their totals are well prepared. After doing so, add them into your digital budget program or open them and watch as your family budget begins to gain momentum. Always remember that your immediate goal is to ensure that your income is always more than your expenditure.

With your financial numbers well laid before, you can tackle your family budget more objectively. As we said before, your discretionary expenditure could be the main game-changer. You could allocate money every month only for the necessary expenses, and cultivate a culture of not spending even a dollar more than you plan.

With less overspending, you can use the extra cash to accumulate better savings and reduce your debts. Consistency with the above steps will pay off in the long run, and you’ll be headed towards financial freedom in no time.

Conclusion

Money and budget management are not as complex as you think. Once you follow the step-by-step guide above to develop a realistic family budget, controlling your family’s finances will be much more manageable. Get a good hold on how much money you earn, how much money you owe, and where your money is going.

After this analysis, set up structures to help you cut back on unnecessary expenditures and use the extra cash to achieve your financial goals.

Do you have any other proven steps of coming up with a reasonable family budget? Kindly share with us by commenting below.

Daniel Miller is an experienced specialist in the business and financial area. Daniel has also worked as a financial advisor at a bank and provided consulting and advice about budgets, savings, insurance, stocks, retirement funds, tax advice, etc. He is currently doing specific research on the topic.